First Thursday Minutes – October 3, 2019

Discussion items

1) Tax Withholding Estimator – new and improved!

Tax Withholding Estimator helps retirees; figures tax on Social Security benefits

New IRS Tax Withholding Estimator helps workers with self-employment income

2) Tax-Exempt Organization Update

Treasury and IRS issue proposed regulations and provide relief for certain tax-exempt organizations

3) Tax Security 2.0

Here’s what tax pros can do so they aren’t taken on a phishing trip

It’s important for tax pros to know the signs they are a cyberthief’s victim

4) National Work and Family Month

The IRS is participating in National Work and Family Month by issuing a series of informative tips on work-life balance throughout the month of October. The agency plans a series of news releases, fact sheets and tax tips. Topics covered include family-owned businesses, family tax credits, military tax benefits and scams and security issues.

5) Data security message to PTIN holders

Email sent to tax pros from the Return Preparer Office on September 24, 2019.

“When completing your PTIN renewal, a checkbox will be available to confirm your awareness of these data security responsibilities.”

Email was sent via “Gov Delivery” from irs@service.govdelivery.com.

“FOIA Awareness for PTIN Holders” reminder:

Legitimate IRS emails regarding PTIN issues are sent from two email addresses: irs@service.govdelivery.com and Taxpros@ptin.irs.gov.

6) QBI and rental real estate

State Departments of Revenue Minnesota – Mark Krause

- We updated the withholding tax tables effective 9/4/19. The new tables are included in the Withholding Tax Instructions on our website.

- Final drafts of 2019 forms and instructions have been posted to the Software Providers page on our website. 2019 Instructions for the M1 and M1PR will be posted later this year.

Your issues and questions:

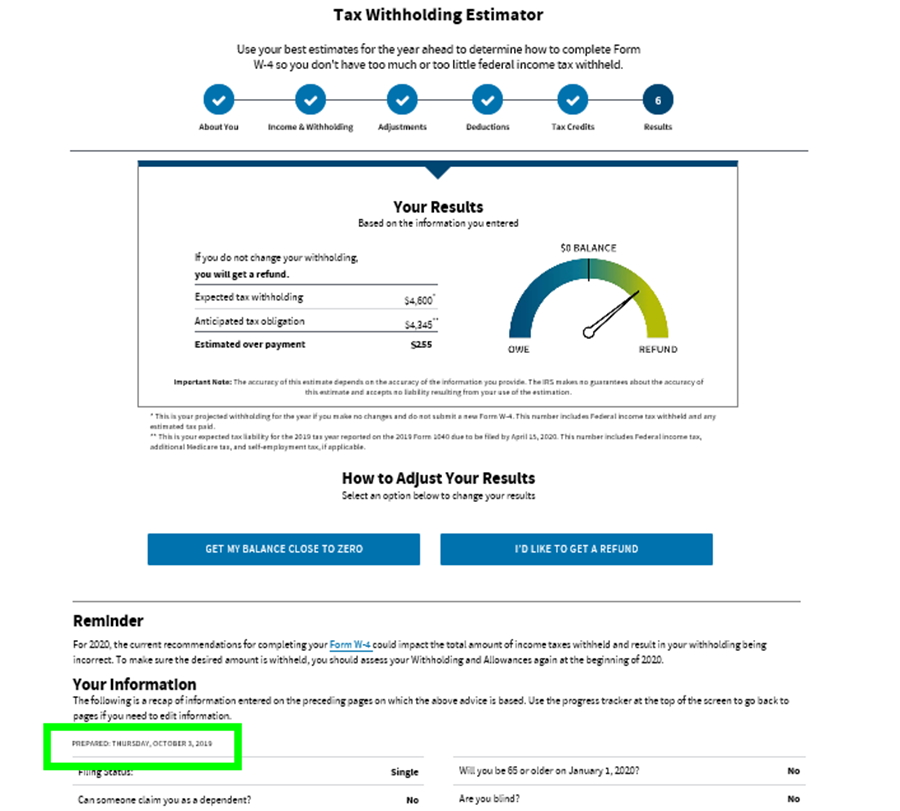

1) Comments on the Tax Withholding Estimator and Form W-4

Comment: The “results page” should show the date it was prepared.

Response: It does. 😊 See the green box below.

Comment: Tax pros made a request for changes to Form W-4 and W-4P for 2019. They said it would be better to allow taxpayers to state a percentage of income they want withheld from each paycheck, or a dollar amount they want withheld from each paycheck.

Response: We put that suggestion in IMRS. The draft Form W-4 for 2020 changes how withholding is calculated. The time period for making comments on the draft closed on September 9th, so it seems doubtful that the IRS will be able to accommodate your request for changes to the 2020 Form W-4.

However, IRS is constantly seeking feedback from the tax community. Comments regarding forms and publication can be provided to IRS at https://www.irs.gov/forms-pubs/comment-on-tax-forms-and-publications .

In addition, the draft 2020 Form W-4 (Employee’s Withholding Certificate), Form W-4V (Voluntary Withholding Request (For unemployment compensation and certain Federal Government and other payments) and Form W-4P (Withholding Certificate for Pension or Annuity Payments) will and do offer the opportunity for a taxpayer to request specific dollar amounts or a percentage of each payment they want withheld as a federal income tax payment.

The draft 2020 Form W-4 includes Step 4(c) – Extra Withholding. The draft instructions state that the step can be used to enter “any additional tax you want withheld from your pay each pay period.”

The 2019 Form W-4V instructions identify that for any social security benefit received the filer of the form may choose to have the SSA withhold federal income tax of 7%, 10%, 12% or 22% from each payment, but no other percentage or amount.

The 2019 Form W-4P includes line 3 which allows the taxpayer to identify an additional amount they want withheld from each pension or annuity payment. The IRS is scheduled to release a draft 2020 Form W-4P sometime this fall.

Please see:

- IRS, Treasury unveil proposed W-4 design for 2020 – link to Draft Form W-4 dated Aug. 8, 2019

- FAQs on the draft 2020 Form W-4

- Form W-4V (Voluntary Withholding Request)

2) Error in Tax Calculation in Schedule D Tax Worksheet

This page on IRS.gov says that some taxpayers will be receiving refunds. Tax pros state that some clients are receiving refunds. However, there are two problems:

1) The taxpayer gets a refund check but no letter of explanation. Tax pros state that the IRS should always send a letter at the same time as the refund. A refund check with no letter causes concern for the taxpayer, and they often believe their tax preparer must have made a mistake.

2) In some cases, the refund is not calculated correctly. The IRS is not calculating Section 1250 and the QBI Deduction correctly.

RESPONSE: We entered this in IMRS and will keep you posted.

3) An issue with an amended return

What happened:

- A dependent filed his tax return and stated that he cannot be claimed as a dependent.

- He CAN be claimed as a dependent and he amended his return to say so.

- The IRS has processed his amended return.

- The parents are filing now and trying to claim him as a dependent.

- They can’t e-file with him as a dependent. Why not?

RESPONSE: The IRS computer system is reporting how the dependent originally filed, claiming that he is not a dependent on someone else’s return. The computer system doesn’t get updated from his amended return which would allow the parents to e-file. The parents will have to paper file to claim their son as a dependent.

4) PTIN question

The Return Preparer Office told tax pros: “When completing your PTIN renewal, a checkbox will be available to confirm your awareness of these data security responsibilities.”

Question: Will all PTIN holders be required to answer the question? Including supervised employees?

Response: Yes, all PTIN holders will have to answer this question.

5) How do we get in touch with Wisconsin Department of Revenue to get a taxpayer in “uncollectable status”?

RESPONSE:

- Send an email to DORCompliance@wisconsin.gov, or call (608) 266-7879.

- See also Can’t Pay in Full?

6) How do we get in touch with Illinois Department of Revenue for collection issues?

RESPONSE:

- Illinois tax information can be found on https://mytax.illinois.gov.

- Look for “Contact” at the top of the page.

- Select “Contact IDOR”.

- There are offices throughout the state where answers can be obtained from a DOR agent either in person or over the phone.

- See also Payment Plan.

Next Call

The next call will be on November 7. We’ll send out the WebEx link closer to that date

Meetings are one hour long. Come when you can, leave when you must.

Thank you to everyone who attended. We appreciate your time and input!