First Thursday Minutes – November 7, 2019

Stakeholder Liaisons

Doug Blade

Kathleen Fox

Cathye Mason

Mike Mudroncik

Sherry Saucerman

Stakeholder Liaison Manager

Kristen Hoiby, Area 6

Departments of Revenue

IL Maribeth Oliver

MN Mark Krause

Tax Professionals

Gail Bates

Darrel Beadle

Ron Berman

Jacob Borash

Velma Bjorgum

Barbara Brown

Leslie Chambers

Carrie Christensen

Tracy Danzer

Laura Dawson

Brad Decker

Susan Du

Jodi Eckhout

Jessica Gatzke

Kelly Golish

Jacen Gondringer

Joel Guthmann

Steven Heeley

Cindy Hockenberry

Kelly Jaskowiak

Lourdes Jimenez

Terry Johnson

Mercean Lam

Judy Lashinski

Laura

Brian Murphy

Jodee Paape

Darian Panasuk

Kathy Reiniger

Jo Ann Schoen

Joan Scholl

Barbara Steponkus

Will Wallace

Jill Wrensch

Currently, there are no webinars scheduled. Information about future IRS webinars for tax professionals can be found at https://www.irs.gov/businesses/small-businesses-self-employed/webinars-for-tax-practitioners.

Discussion items

1) Virtual Currency: IRS Issues Additional Guidance & Reminds Taxpayers of Reporting Obligations

2) IRS Urges Taxpayers to Get Ready to File their 2019 Taxes

3) Online Option for Tax Pros to Earn CE Credits

4) Tax Pros Need to Renew their PTINs

5) Final and Proposed Regulations: Additional First Year Depreciation Deduction

6) Treasury Decision 9878 – Rules and Procedures for Electing Disaster Loss Claims

7) New Payment Option Available to Taxpayers in Private Debt Collection Program

State Departments of Revenue – Minnesota – Mark Krause

-

- Based on feedback, we have updated the POA forms and mail appointees can receive. We separated Form REV184, Power of Attorney, and Form REV185, Authorization to Release Tax Information, into forms for individuals and businesses.

- We will still accept Form REV184 with a revision date of 12/2014 or 01/2017. Customers will be able to remove a POA appointee using the new Form REV184r, Revocation of Power of Attorney.

- Revenue will now send refund checks and correspondence about refunds directly to customers. We will send all other correspondence to the POA appointee if selected. For more detailed information, see our POA web page.

Illinois – Maribeth Oliver

- The Illinois Tax Delinquency Amnesty Act provides the opportunity for taxpayers to pay outstanding eligible tax liabilities and to have eligible penalties and interest forgiven on taxes paid in full during the amnesty period. Eligible liabilities are taxes due from periods ending after June 30, 2011, and prior to July 1, 2018.

- If you have an existing tax liability, make full payments of your eligible tax liability between October 1, 2019, and November 15, 2019. If you failed to file a tax return or incorrectly reported the liability due on a previously filed return for these tax periods, now is the time to file returns, make corrections, and pay the tax. You must file an original return for non-filed periods or file an amended return to make corrections

Your issues and questions:

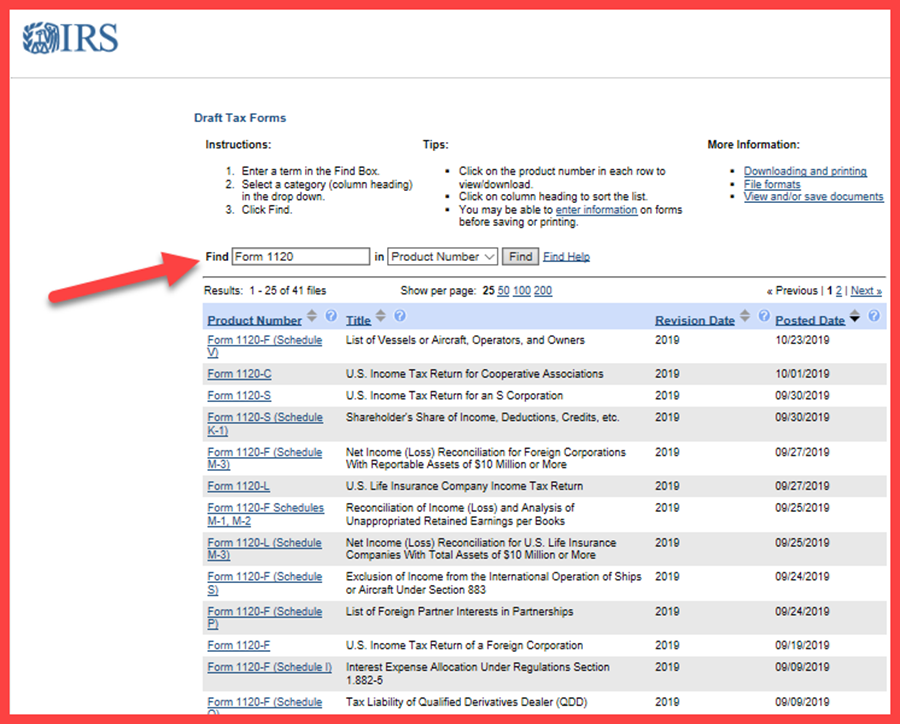

1) When will the IRS issue drafts of the 2019 Forms 1120?

Response: Drafts of the forms associated with the 2019 Form 1120 can be found at www.irs.gov/draftforms and then using the search box by typing in Form 1120 (please see screenshot below). The draft of the Form 1120 itself was published on August 21st.

2) Based upon the meeting’s discussion of Treasury Decision 9878 (Rules and Procedures for Electing Disaster Loss Claims), there was a question regarding the correct due date when a taxpayer files for an extension, resides in an area declared a federal disaster area and the IRS postpones filing and payment obligations for taxpayers in that area to a date beyond the original extension date? The Q & A’s documented below can be found at https://www.irs.gov/businesses/small-businesses-self-employed/faqs-for-disaster-victims-extensions-of-time-to-file .

Question: A taxpayer whose individual income tax return (Form 1040) is due to be filed on or before April 15, 2013, timely files an extension of time to file the return under section 6081 thereby extending the due date to October 15, 2013. If the county in which the taxpayer resides is declared a federally declared disaster area and, pursuant to section 7508A of the Internal Revenue Code, the IRS postpones filing and payment obligations for the period September 1, through November 4, 2013, when is the taxpayer’s Form 1040 now due?

Answer: The due date for filing the individual income tax return is the later of the end of the postponement period or the extended due date. Here, the postponement period ends on November 4, 2013, which is later than the extended due date (October 15, 2013). Therefore, the taxpayer’s individual income tax return is due November 4, 2013.

(06/09) Question: What is the effect of filing an extension of time to file under section 6081, if, prior to the March 15, 2013, due date for filing a U.S. Return of Partnership Income (Form 1065), an event in the state and county in which the partnership was formed, results in the area being declared a federally declared disaster area and, pursuant to section 7508A of the Internal Revenue Code, the IRS postpones filing and payment obligations for the period March 1, 2013, through April 30, 2013?

Answer: The due date for filing the partnership return is the later of the extended due date or the end of the postponement period. If the partnership, which is an affected taxpayer with respect to the federally declared disaster, filed an extension of time to file prior to the end of the postponement period (April 30, 2013), the extension would relate back to the original due date, March 15, 2013. The extension would run from March 15, 2013, to September 16, 2013. Because the extended due date (September 16, 2013) is later than the end of the postponement period (April 30, 2013), the partnership’s Form 1065 is timely if filed on or before September 16, 2013.

(06/09) Question: A corporate taxpayer whose U.S. Corporation Income Tax Return (Form 1120) is due to be filed on or before March 15, 2013, files an extension of time to file under section 6081 prior to the due date for filing the return thereby extending the due date to September 16, 2013. If, as a result of a disaster, the county in which the corporate taxpayer’s principal place of business is located is declared a federally declared disaster, and pursuant to section 7508A of the Internal Revenue Code, the IRS postpones filing and payment obligations for the period July 1, 2013, through August 30, 2013, when is the corporate taxpayer’s Form 1120 now due?

Answer: The postponement period under section 7508A runs concurrently with any extensions of time to file and pay under other sections of the Internal Revenue Code. The return is due the later of the extended due date or the end of the postponement period. If the extended due date occurs prior to the end of the postponement period, the return is due to be filed at the end of the postponement period. If however, the postponement period ends prior to the extended due date, the return is due to be filed on the extended due date. Here, the extended due date (September 16, 2013) is later than the end of the postponement period (August 30, 2013), therefore, the corporate taxpayer’s Form 1120 is due September 16, 2013. Unless the corporate taxpayer also filed an extension of time to pay pursuant to section 6161, the corporate taxpayer’s payment would be due on August 30, 2013, the last day of the postponement period.

Next Call

The next call will be on December 5. We’ll send out the WebEx link closer to that date

Meetings are one hour long. Come when you can, leave when you must.

Thank you to everyone who attended. We appreciate your time and input!